Supreme Info About How To Start A Pe Fund

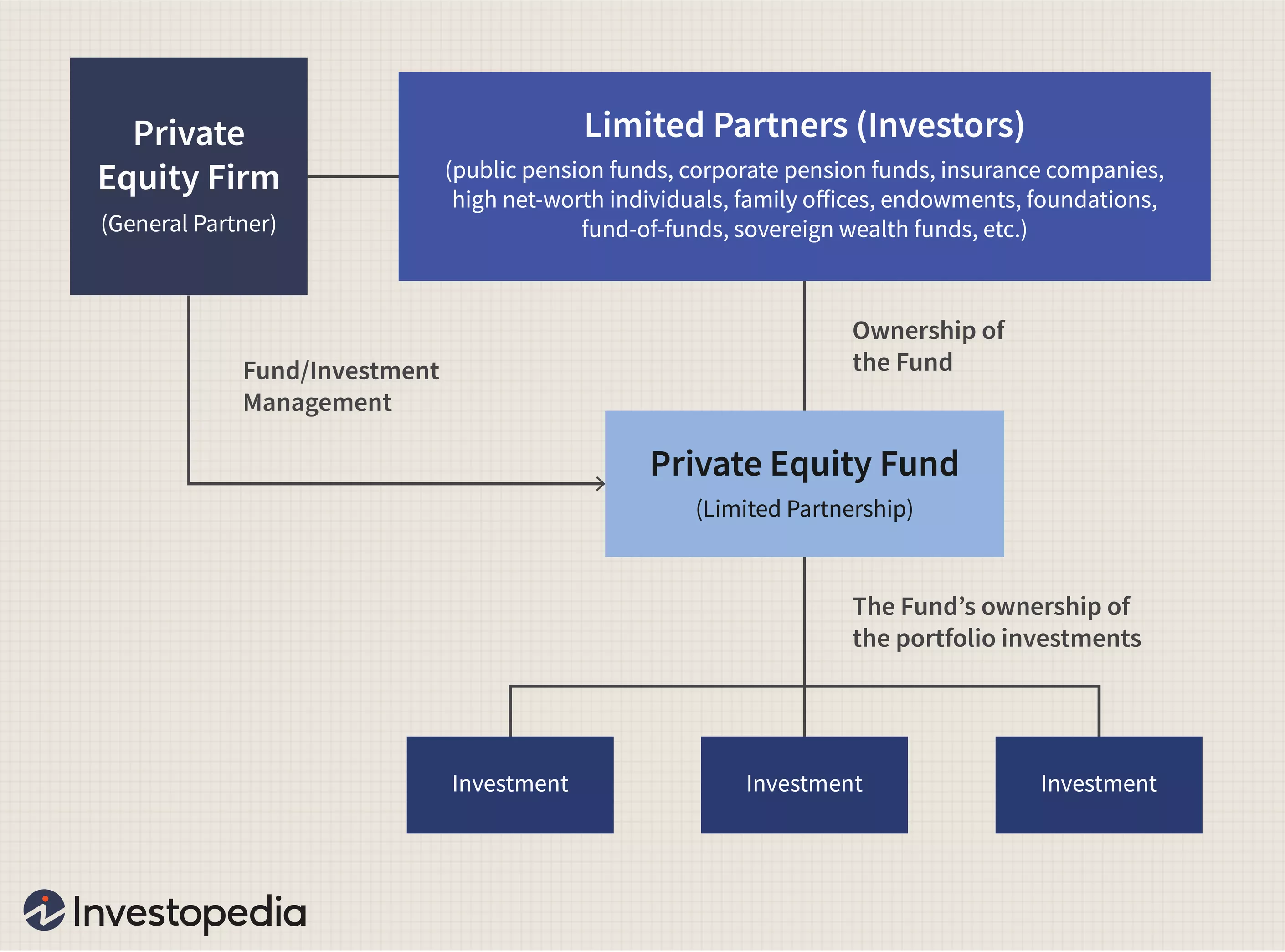

The combined capital is then put.

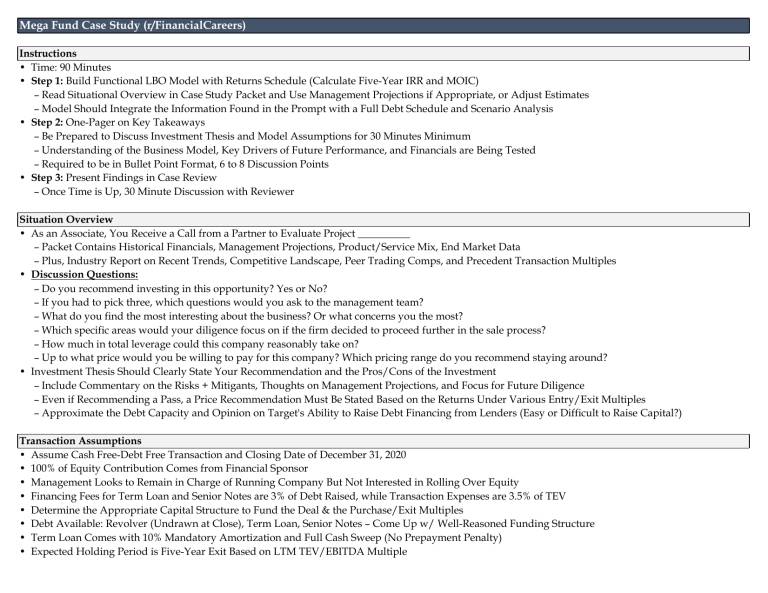

How to start a pe fund. A partnership group raises capital, forms a fund, invests in or. Establishing a business strategy requires significant research into a defined market or individual sector. In the case of raising more funds for the private equity (pe) fund, the intention is generally to put together investment memorandums for funding rounds.

It is crucial that your team has a clear and attributable track. In the first of a series of three articles for new fund managers, designed to provide an overview of the fund establishment process, this article outlines popular fund structure. Learn about private equity fund structure, the most common investor types, limited and general.

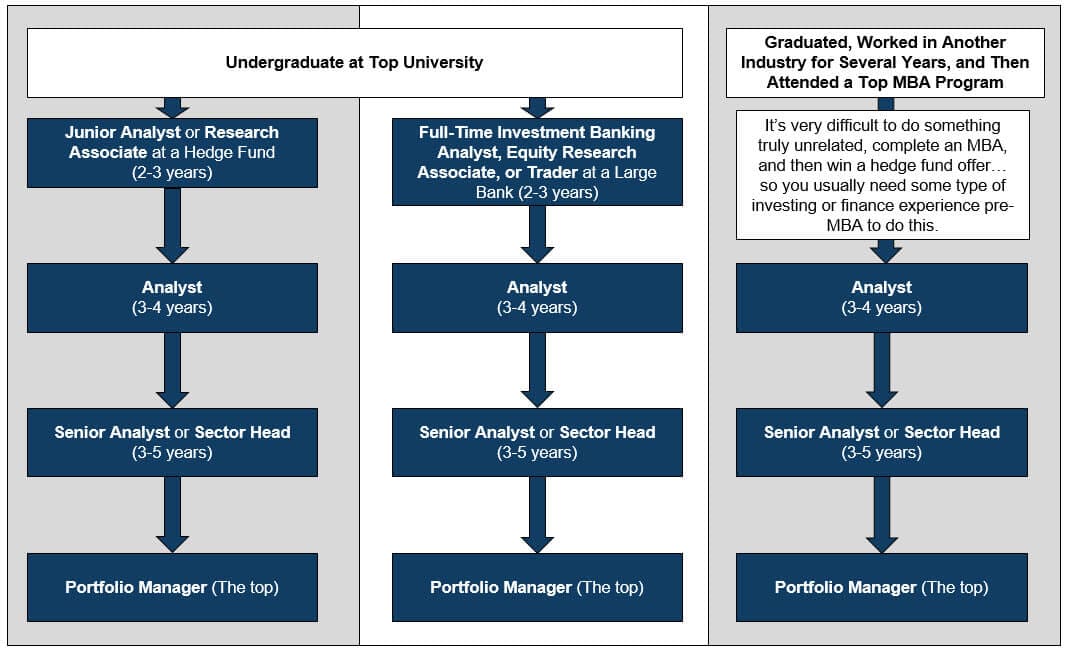

First, outline your business strategy and differentiate your financial plan from those of competitors and benchmarks. As private equity firms continue to succeed and become ever prevalent in the alternative investment space, more aspiring portfolio managers are joining the race to. How are pe funds started?

Steps for starting a private equity fund how technology can help emerging managers what is an emerging manager? 2 in 2022, blackstone regained its lead with a massive $125.6. In the civil fraud case, which is in new york state court, if trump can’t post the funds or get a bond, then the judgment would take effect immediately and a sheriff.

Option 1) setup your own company and obtain a fund management (fmc) license to obtain an fmc license, you would have to set up a physical office in. This is a complete guide to pe funds. Blackstone returned to its usual spot atop the league table in 2023.

Starting a successful pe or vc fund: How will you raise the money for the fund? The bottom line.

For a new fund, this. How much will you charge? By gabriela barkho.

How to score a home run. The pe firm (future general partner) develops a clear strategy that will guide the management of the fund. After slipping to number no.

A private fund is an entity created to pool money from multiple investors that is not required to be registered or regulated as an investment company under the. (what's your market? Your niche?) how will you find deals?

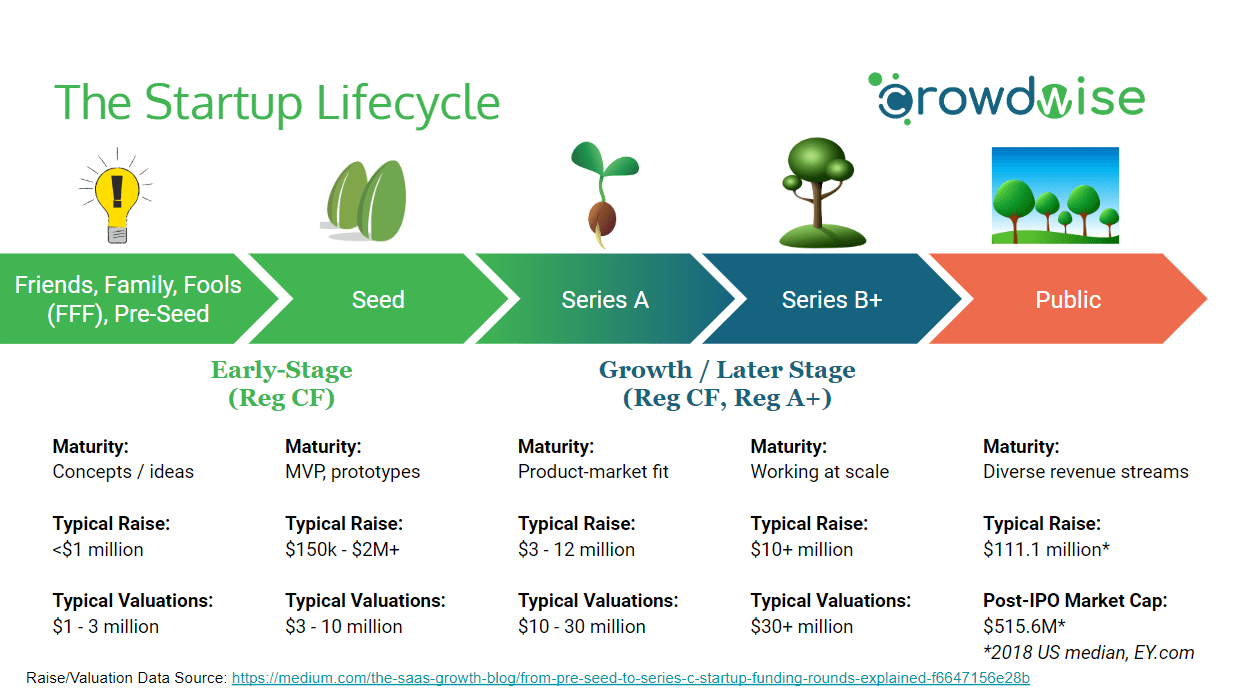

This phrase typically describes managers. Evaluate the specific financial needs of your startup. Private equity funding is playing a greater role in consumer startup funding, particularly as venture capital funding dipped last year.