Amazing Tips About How To Reduce Net Working Capital

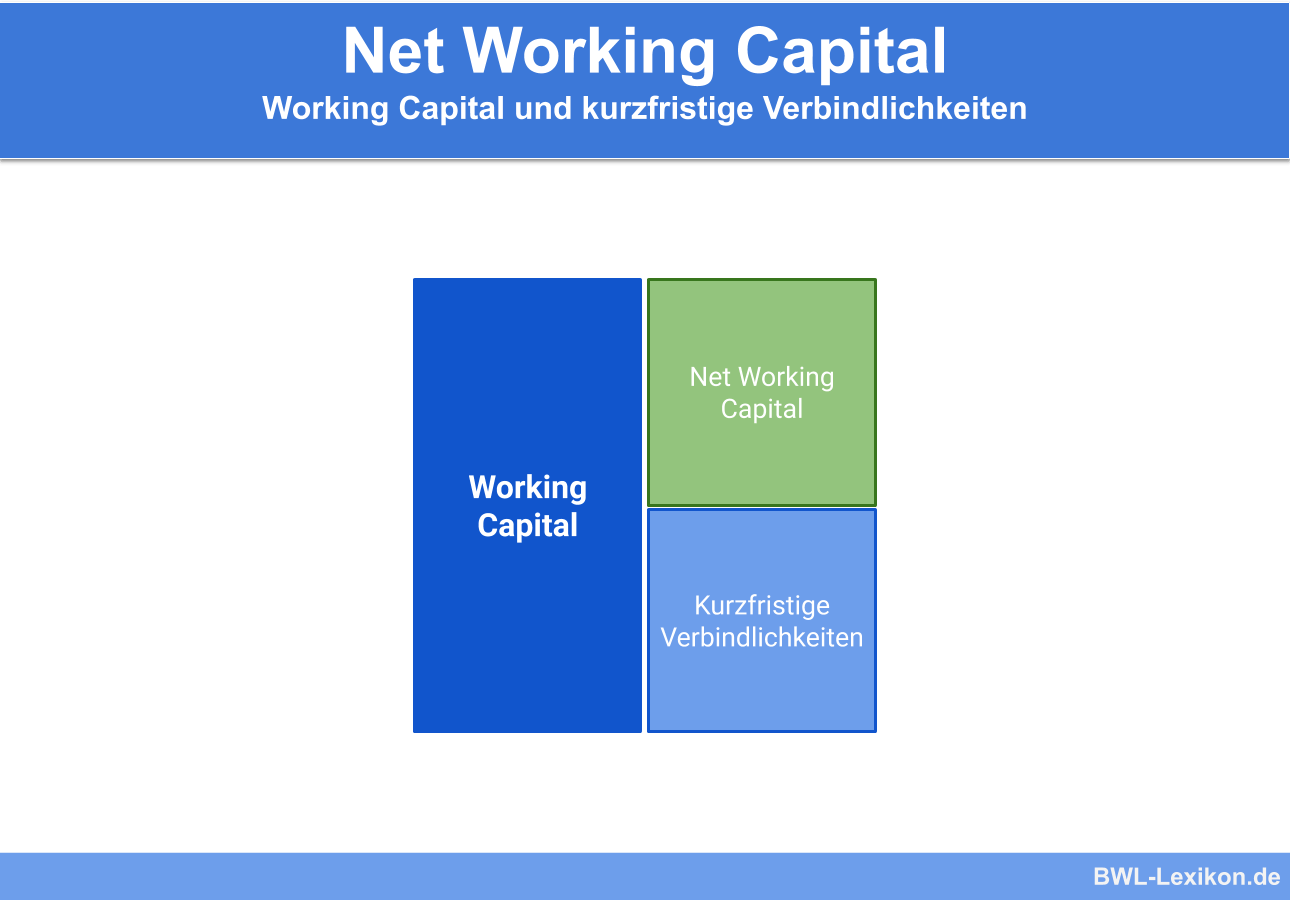

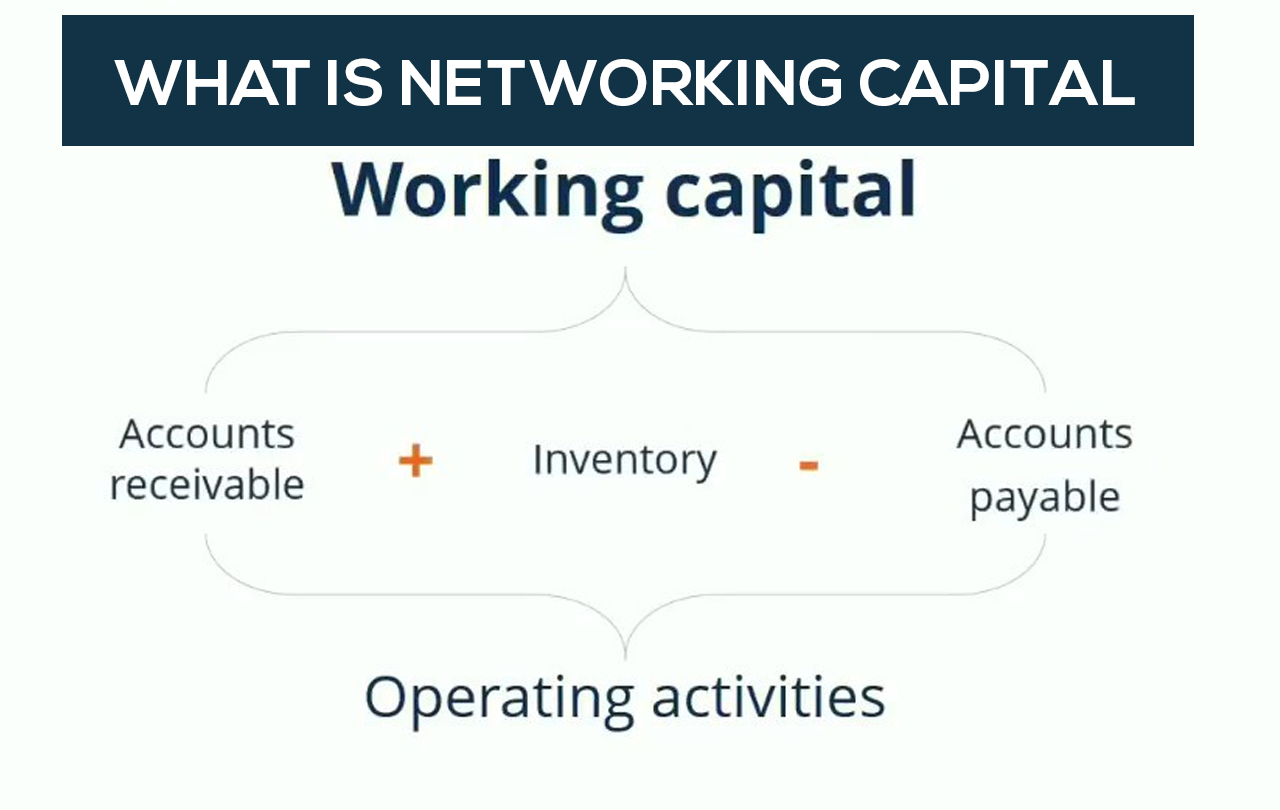

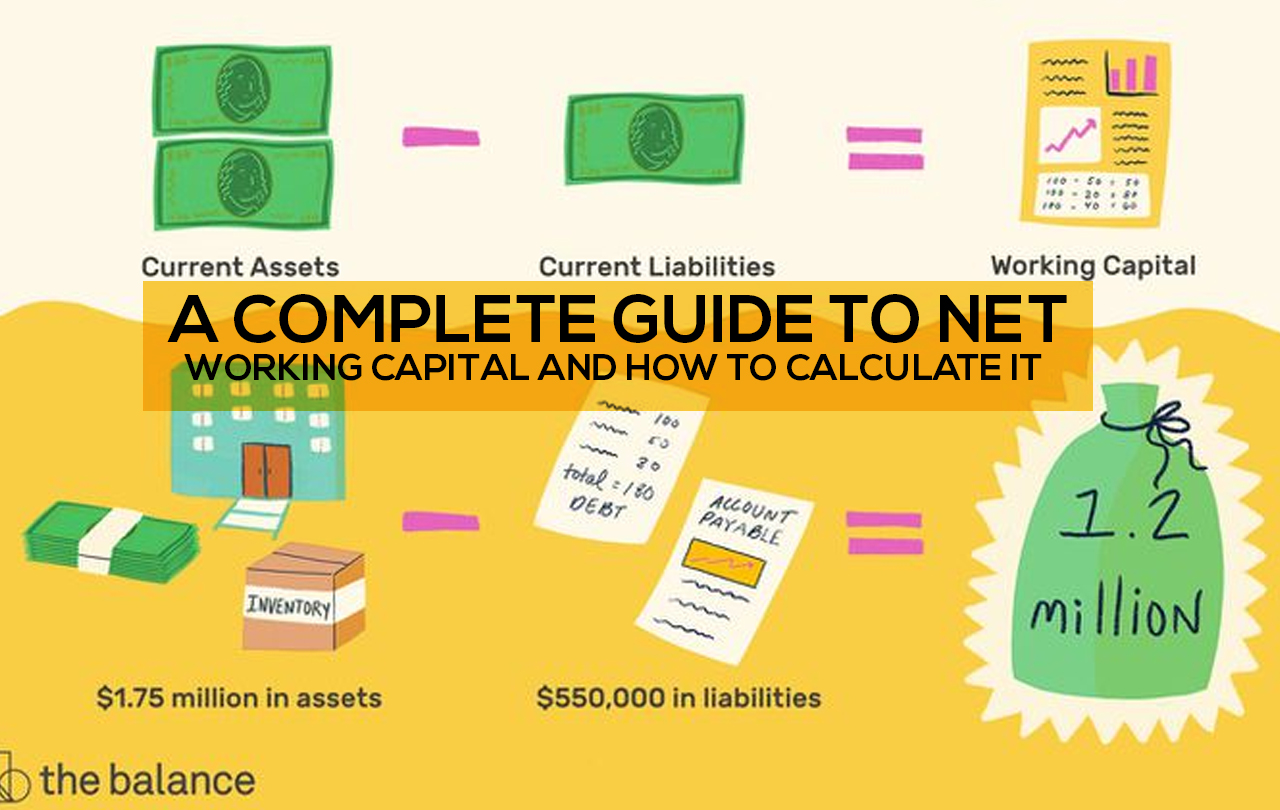

Key takeaways working capital, also called net working capital, represents the difference between a company’s current assets and current liabilities.

How to reduce net working capital. To determine net working capital, we subtract the total value of current liabilities from the total value of current assets. While this investment strategy can reduce the business' current asset total and its net working capital, a highly stable business with minimal expenses may decide. Any cash a business has can be used.

Let’s see how to reduce working capital. Learn about the working capital cycle formula, the perks of a shorter working capital cycle, and four key strategies to enhance working capital efficiency. Reduce net working capital:

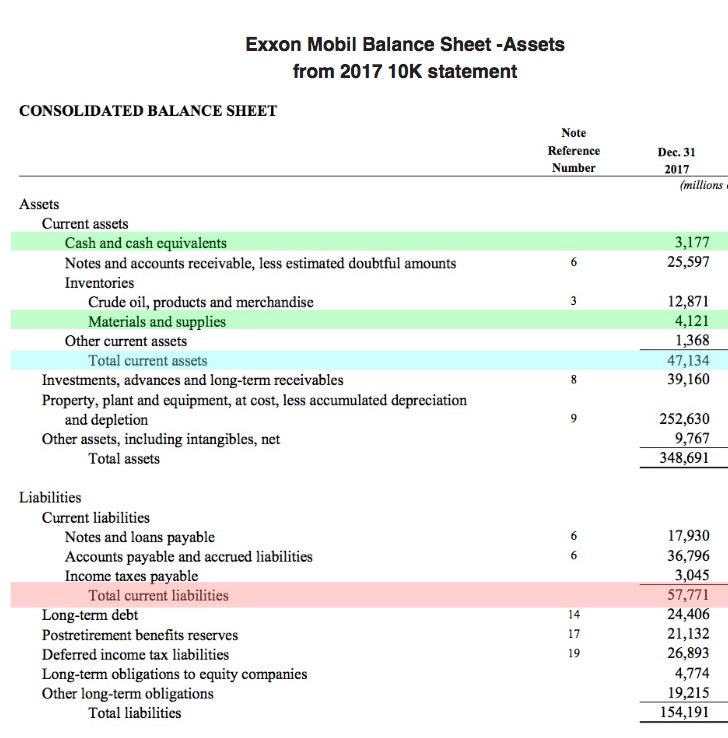

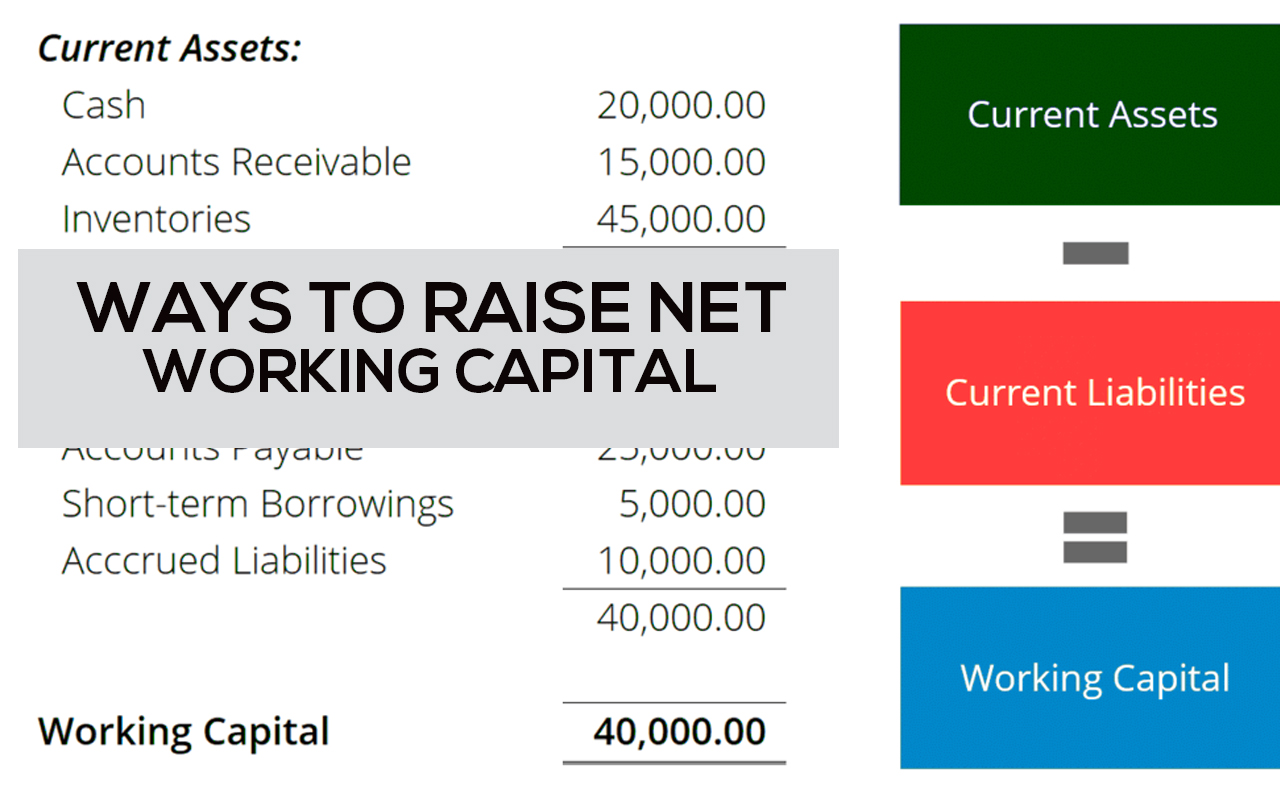

There are a few different methods for calculating net working capital, depending on what an analyst wants to include or exclude from the value. How to calculate net working capital. Net working capital = current assets (minus) current liabilities.

Current liabilities include £40 of accounts payable, £30 of taxes payable, and £25 of revenue that has been recorded for services not yet provided (i.e. Before we dive into how to increase working capital for your business, it’s vital to ensure that you’re calculating your working capital correctly. If global warming is to be limited to 1.5 degrees celsius by 2050, work must begin now to build a.

This way to improve your. Rigorous management of nwc can help companies cope with unexpected disruptions to the business. Positive working capital is when.

Naturally, your net working capital. Here’s what to know about trump’s massive civil judgments. The formula is as follows:

Even if leadership teams have few external options to increase nwc, such as renegotiating contract terms, internal actions can deliver significant value.

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)