Inspirating Info About How To Obtain An Sba Loan

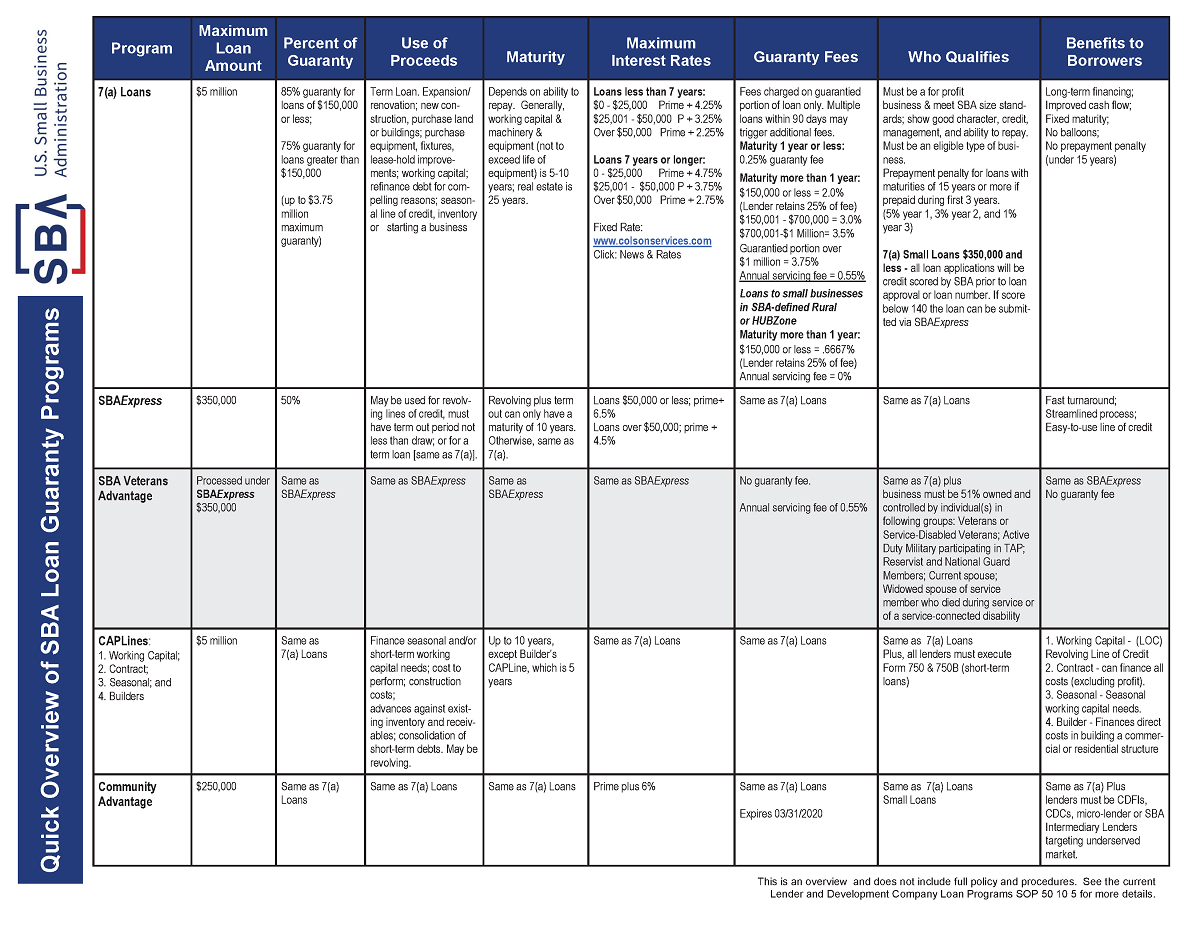

Small business administration (sba) loan:

How to obtain an sba loan. How to get an sba startup loan in 6 steps. An sba loan is a small business loan that’s at least partially backed by the u.s small business administration. In order to get an sba loan, you first and foremost need to make sure you’re eligible for an sba loan.

Make a payment to sba. There’s no guaranteed way to get venture capital, but the process generally follows a standard order of basic steps. Enter your zip code on lender match to find a lender in your area.

How to get venture capital funding. You apply for an sba loan through a lending institution like a bank or credit union. As a business owner, you must have invested equity — such as time or money — into the business.

Securing a business loan is a complex process with many moving. Some types of sba loans have a faster approval process, such as sba microloans or. You need to enter the following elements into the calculator to determine the cost of an sba loan.

What is an sba loan? Learn how to make a payment on your sba loan or check your account balance and due date. Learn about sba loans.

Apply for a loan through your local lender. The small business owner’s guide to getting an sba loan. You can choose from these options:

Determine your eligibility for an sba loan. You can use sba’s lender match tool to connect with a participating sba lender. Visit our loans page to find the loan that best suits your need.

Start your business. Small businesses turn to commercial loan brokers for help when they need: Make a payment to sba.

How do i apply? You will apply for your loan directly through your lender. And while charge offs on sba's covid eidl loans remain low, at about 0.6%, compared to its disaster loan program of 1% to 2%, that is because the repayment.

Only lenders who partner with the sba can offer sba loans. Follow these steps to get an sba startup loan. How to apply for an sba loan.