Painstaking Lessons Of Tips About How To Get Out Of Debt In Canada

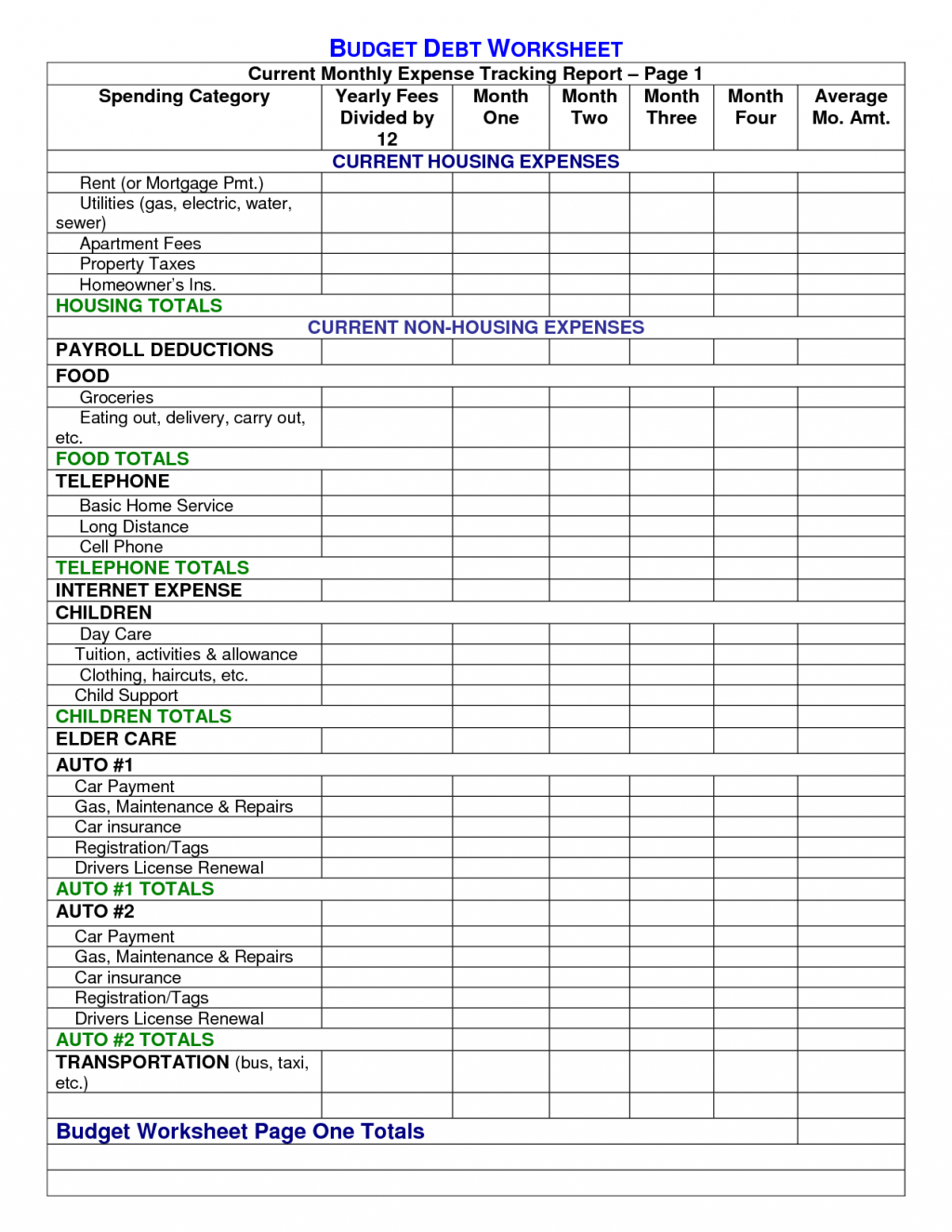

The interest rate your list may include:

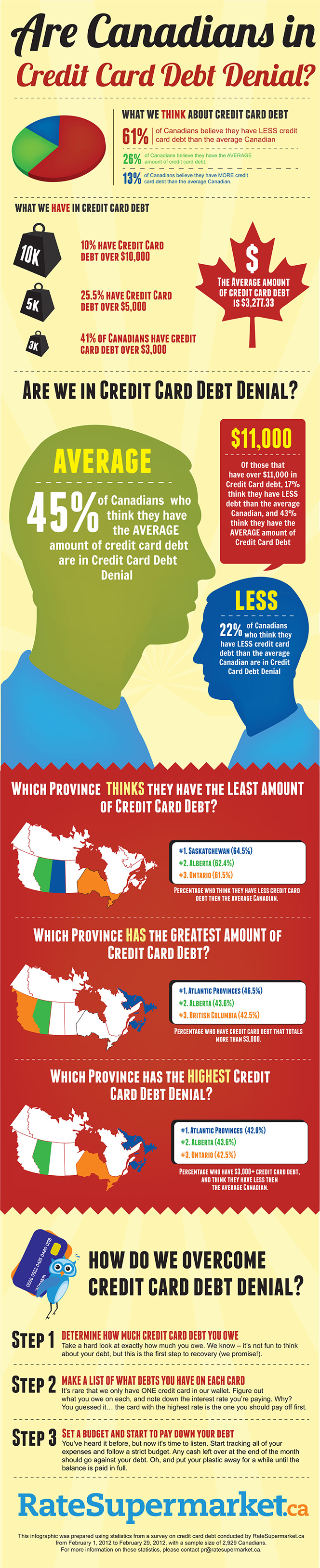

How to get out of debt in canada. It's important to get out of debt to take control of your financial freedom! Looking for help with your debt? In 2018 canadians held a whopping $1.83 trillion in consumer debt, according to an equifax report.

| listen debt: Compare offers from multiple lenders and log in regularly to see if new offers are available. This is your starting point for getting out of debt.

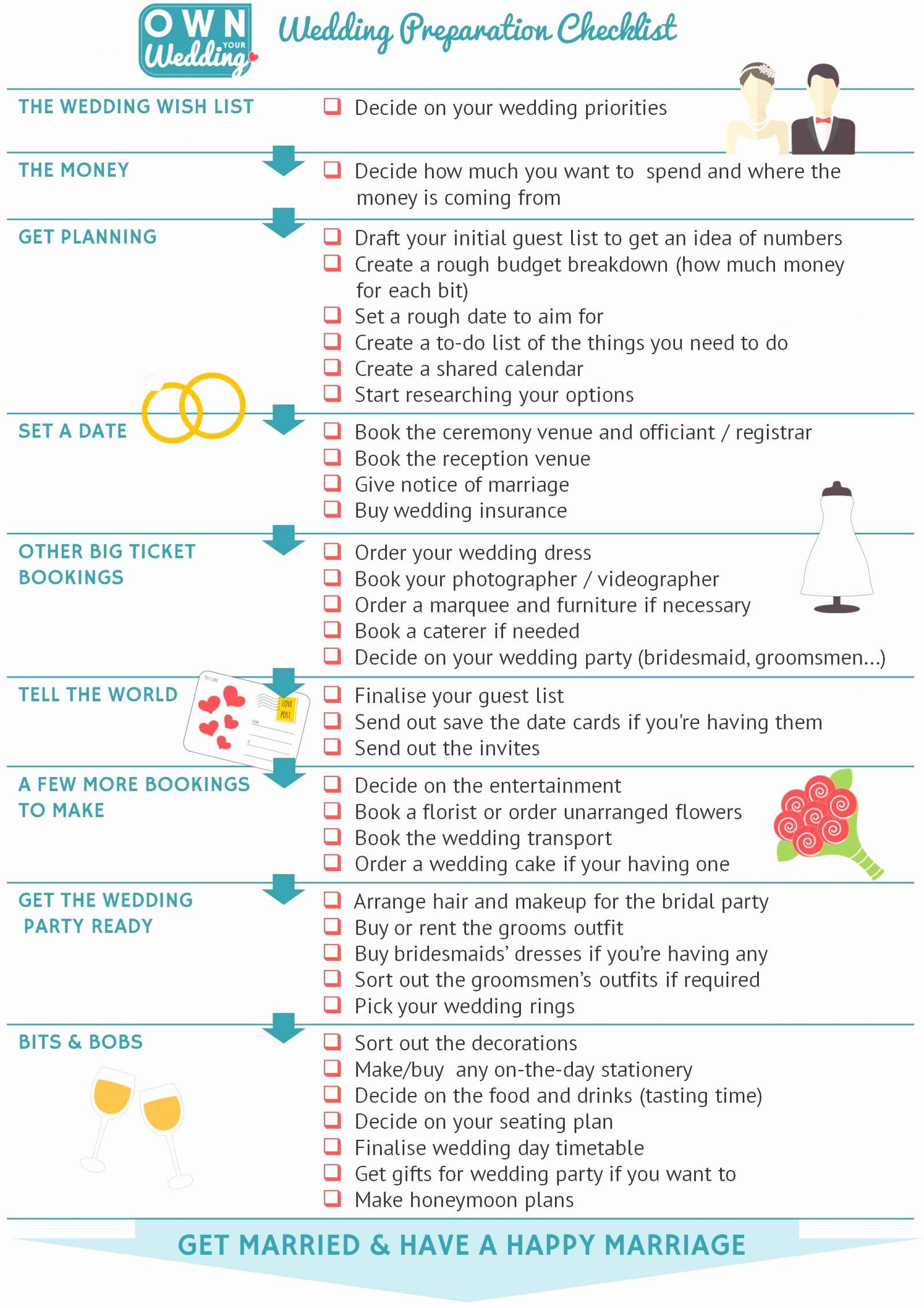

Realizing your financial situation is worse than you thought can be worrying,. Pay more than the minimum 5. To get to this number, you’ll need a budget that tracks all your income and.

A former british airways employee has allegedly fled to india after being arrested for allegedly helping indian citizens get around immigration laws so they could. Start by identifying what you owe. Plug the black hole 3.

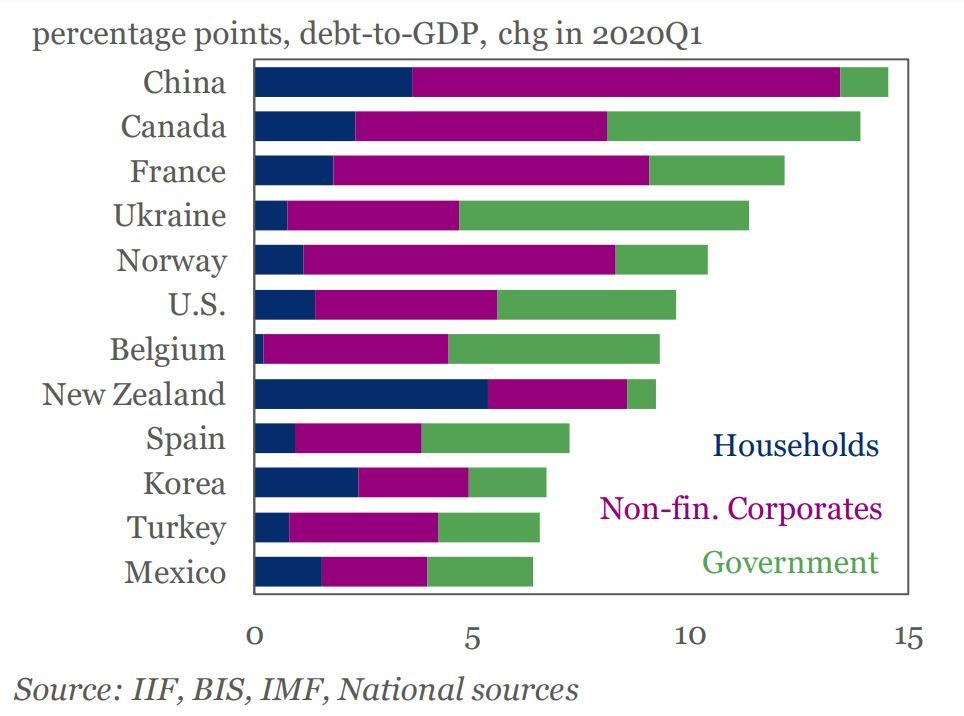

Put a budget in place. Choose between secured and unsecured loans. Canada has the highest level of household debt to disposable income of any g7 country, statistics canada reported wednesday.

Get credit counseling if you need it if you're drowning in debt, get help. Cut back on spending 3. Know and write down how much you earn 2.

Maybe you've heard that deferring mortgage payments or consolidating what you owe can help. Free to set up with the help of a credit counsellor or trustee; The minimum monthly payment 3.

Almost all canadians have it. Find a secured bad credit. Snowball method the snowball method is a debt repayment strategy that involves first paying off your smallest balances.

Rank your dollar amount interest. Overview of canada's 8 debt consolidation options. Categorize your credit card/loans by interest rate 4.

You need to know how much you owe by listing your debt and the interest rate (fees) payable. There are so many debt relief options available in canada, and the one that’s right for you depends on the type of debt and whether you can afford to make debt. The excessively high household debt is a key vulnerability of the canadian economy, and consumers are fearful about their financial futures and their ability to save.