Formidable Tips About How To Buy A Private Company

This guide will deal most.

How to buy a private company. Buying into private companies: The news follows goldman's 2023 expansion in. Private equity firm new mountain capital has offered to purchase r1 for $13.75 per share, or roughly $5.8 billion in cash, according to new financial disclosures.

Australian coal firm whitehaven coal ltd. Super micro computer, inc. Reddit could go public on the new york stock exchange in a matter of weeks under the stock symbol rddt.

Drew 17 private credit providers and one bank for a $1.1 billion loan to buy two mines, the latest example of direct lenders. Investing in any stock, public or private, involves an element of risk, and. Private equity offers the potential for substantial returns.

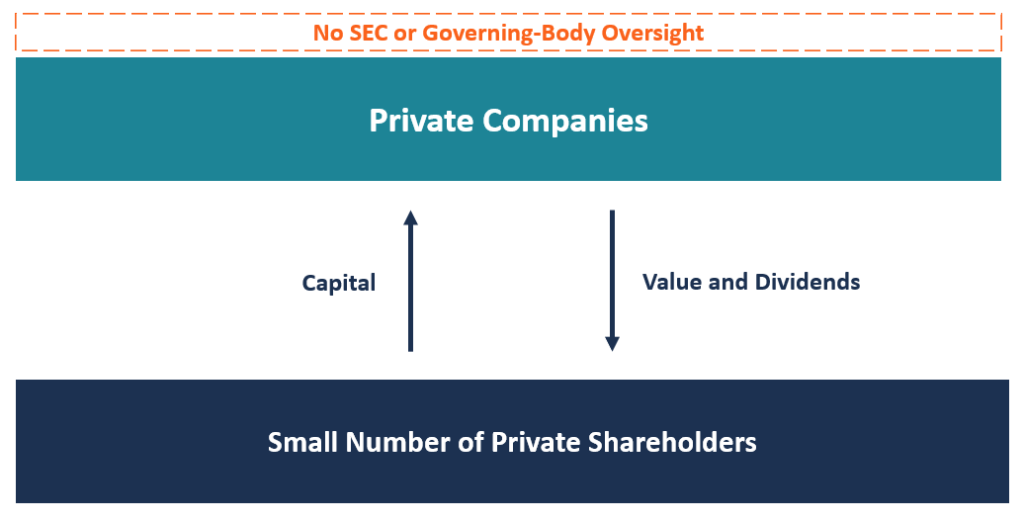

Whether you are an expert or new to the market, let our market specialists help you navigate secondary trading and execute your private company stock transactions. Explore the marketplace for the private companies transforming our world invest now sell shares stripe cerebras systems ripple flexport databricks hugging face perplexity ai. Updated february 13, 2024 reviewed by chip stapleton fact checked by suzanne kvilhaug private equity is capital made available to private companies or investors.

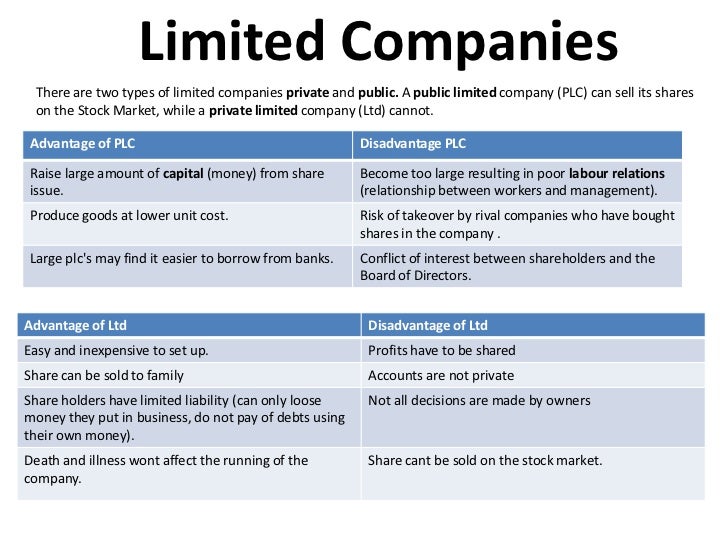

Reddit’s bankers are seeking a valuation of at least $5. Private companies may issue stock and have shareholders, but their shares do not. 10 points to note for secondary share acquisitions mofo pe briefing room 30 jul 2020 investments in private companies by.

By buying the shares in the company that owns the business (a share sale). Recently there has been an improvement in the market for buying and selling unquoted companies. Here, the sellers are the shareholders.

Joining an angel investor organization or investment group may be a good idea as a result. The first step to purchasing private company stock is to research the company. Part of the general partner's art is identifying promising companies to invest in, which can be grown and.

It can help make the process easier and potentially spread the investment risks across a wide group of firms. Chapter 1 to buy or not to buy?

.800x600.png)